- About us

- What we do

- Careers

- Investors

- Insights

- Client portal

What is IR35?

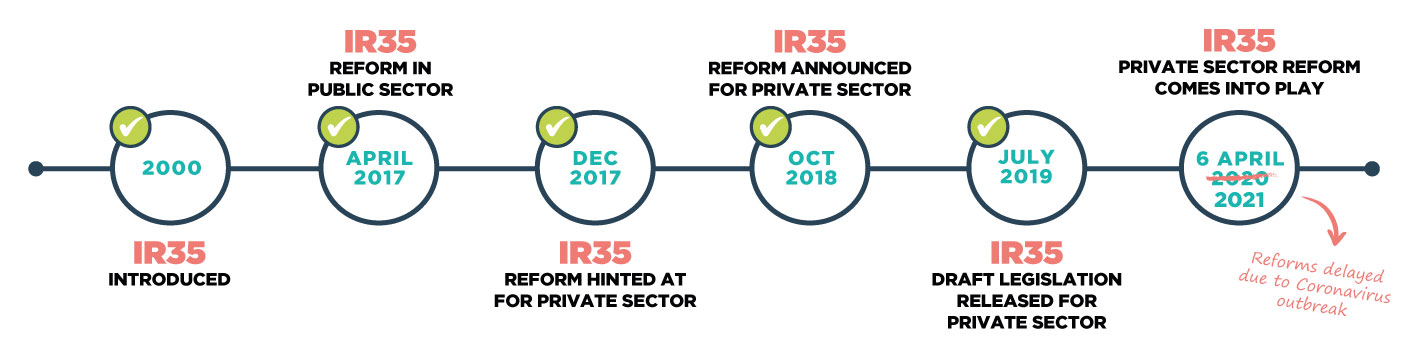

IR35 was introduced in 2000 to address concerns relating to individuals who supply their services via an intermediary (such as a Ltd Company) instead of as an employee, and therefore avoid paying employee income tax and national insurance contributions.

Where an assignment is deemed ‘inside’ IR35, PAYE deductions must be made from the contractor's pay.

Any assignment ‘outside' IR35 is classed as a genuine B2B service and is therefore not subject to the same tax treatment as employees.

Watch our video about IR35 for a deeper explanation.

What do the April 2021 IR35 reforms mean for businesses?

From April 2021, the government extended the IR35 reforms to the Private Sector, following the Public Sector reforms in 2017. The changes do not apply to small companies, which are defined as meeting two of the following three following criteria: turnover of no more than £10.2m; balance sheet total of no more than £5.1m; or no more than 50 employees.

The key change is that the responsibility of defining the IR35 status of the assignment switched from the individual’s Limited Company, to the end-client. This means that companies are also responsible and potentially liable for any misclassifications.

The requirement of the legislation states that all companies must take ‘reasonable care’ when assessing if roles are inside or outside of IR35. Taking a ‘blanket approach’ to assess all roles won’t deliver this.

The potential financial penalties can be significant if incorrect steps are implemented, so it is important that companies have the right tools, processes and partners in place to help them manage their risk, whilst still capitalising on the many benefits of a contractor workforce.

The IR35 reforms for the Private Sector were implemented on 6 April 2021. However, it is important to understand that this is simply the start of the date from which clients will begin to face risk.

Ask a question about IR35

Fill in the form below and ask our IR35 expert Garry a question.

IR35 insights

IR35 reforms for businesses: everything you need to know

Wherever you are on your journey to IR35 compliance, we have some useful insights for you in this article, including links to our recent on-demand IR35 webinar series.

View article

Do your working practices reflect a genuine outside IR35 assignment?

If you’re considering whether your approach is consistent with an outside IR35 determination, we’ve listed some changes which you may wish to consider making to your working practices with contractors.

View article

3 ways a Managed Service Programme can help with IR35 compliance

A Managed Service Programme or MSP could help you manage the upcoming IR35 reforms. Find out how in our short video.

View article

The top 3 IR35 solutions businesses are using to become compliant

Wondering what solutions other businesses are deploying in order to get ready for the upcoming IR35 private sector reforms in April 2021? We break down the top three and what they will mean for you.

View article